Single Touch Payroll - Tax Treatment

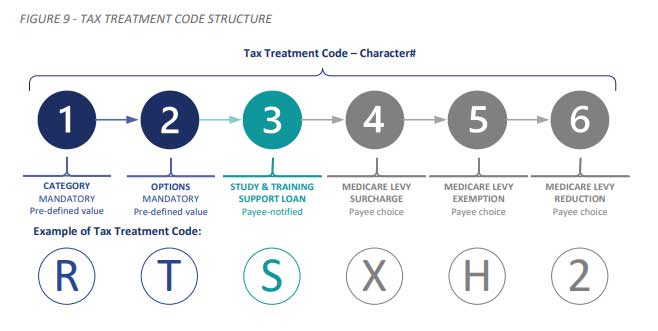

STP Phase 2 reporting includes a six-character tax treatment code for each employee. Tax treatment code is designed to tell the ATO about the employee's employment type, tax withheld, medicare levy status, etc. employers no longer need to send a copy of the Tax File Declaration Form to the ATO.

Code Structure

This 6-character code is comprised of ATO-defined values for each character, where the first 2 characters have specific values for every payee, but characters 3-6 are specific values only if the payee notifies choices, else “X".

the following are the components of the Tax Treatment code:

- Character 1 - Category of tax scale that is a mandatory value and represents an abbreviation of the common reference to the type of payee or regulator. Each category has a unique alpha-value within this character set and the categories are stable but may be removed or supplemented upon government tax policy change. There are enough alpha values available to accommodate future changes

- Character 2 – Options within each Category that represent the variations to the core rate of withholding and is a mandatory value. The values are unique within each category but may be duplicated within this character set (across categories). The options are stable but may be changed upon government tax policy change. There are enough alpha values available to accommodate future changes, however, insufficient to enforce unique values within this character set

- Character 3 – Study and Training Support Loans (STSL) is an alpha field that represents a positive value if the payee has identified the existence of their government-provided loan. This is a single value to represent the response to the polar question of STSL. This value, if positive, will not be impacted by any other variations the payee may claim, such as for a Medicare Levy Reduction based on family income that would exempt the payee from compulsory STSL repayments. This optional variation is not applicable to all categories of tax scales

- Character 4 - Medicare Levy Surcharge (MLS) is an alpha-numeric field that represents the Tier level of any additional Medicare Levy percentage rate nominated by a payee who does not have an appropriate level of private patient hospital cover and earns above a certain income. As the Tier percentage rates are stable, but may be varied by government tax policy changes, only the Tier level is reported, not the actual rate, thus accommodating any future rate change. In this way, although the rates may change, the Tier levels will remain stable. They may only vary if Tier levels are added or removed. This optional variation is not applicable to all categories of tax scales. If the payee meets the conditions to apply the MLS, they cannot meet the criteria for exemption/reduction. These are mutually exclusive. That is, if surcharge, no exemption or reduction can apply

- Character 5 – Medicare Levy Exemption is an alpha field that represents the level of exemption from paying the Medicare Levy claimed by a payee. If an exemption is claimed by the payee, this will reduce the rate of the Medicare Levy component of PAYGW. This optional variation is not applicable to all categories of tax scales

- Character 6 – Medicare Levy Reduction is an alpha-numeric field that represents the number of dependants for low-income earners to reduce the rate of the Medicare Levy component of PAYGW if claimed by a payee. This single field accommodates both the spouse and number of dependent children. This optional variation is not applicable to all categories/options.

Overview of Tax Table Permissions

The table below outlines the components permissible for the tax categories:

Employment Type Permissible Values

Each type of employment permits different type of options for each of the 6-character code:

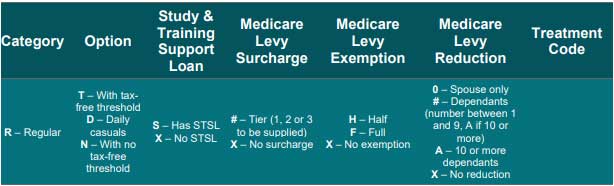

Regular

Due to the large number of possible combinations for this type, we did not list any of the allowed combination. An example would be RTXXXX

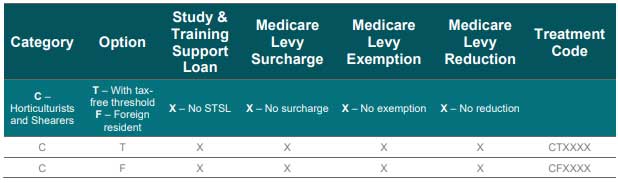

Horticulturists and Shearers

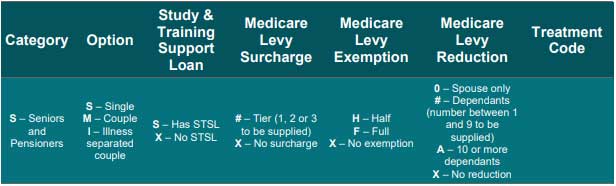

Seniors and Pensioners

Due to the large number of possible combinations for this type, we did not list any of the allowed combination. An example would be SSXXXX

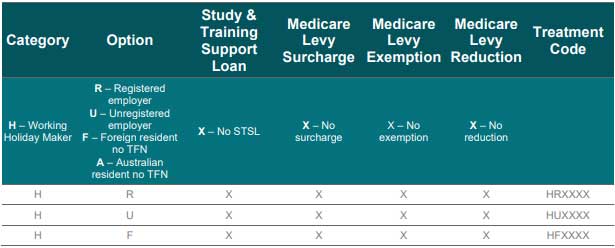

Working Holiday Maker

Seasonal Worker Programme

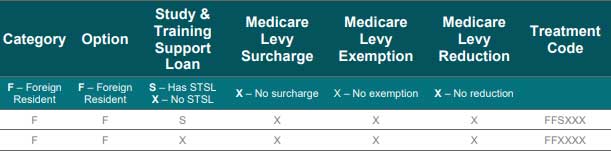

Foreign Resident

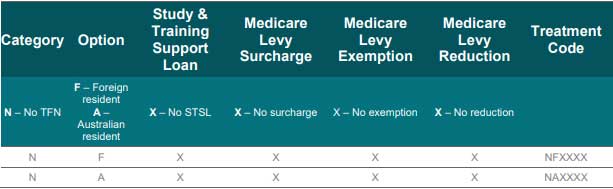

No TFN

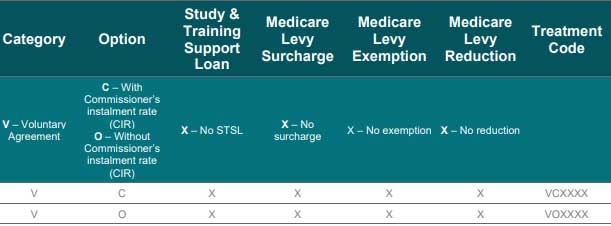

Voluntary Agreement