Single Touch Payroll - Import from an Excel File

Download Single Touch Payroll Report Template

Things You Need To Know!

The following payments should not be included in the employee's Year To Date (YTD) gross:

- Community Development Employment Project

- Government Paid Parental Leave

- Workers Compensation

- Ancillary and Defence Leave

- Overtime payments

- Cashout or any other paid leave payments

- Post-Tax Allowances

- Post-Tax Deductions

- Directors' Fees, Commissions and Bonuses

- Lump Sum Payments

Excel File Contents

The excel file must match the following column contents:

- Employee's Type: it must be one of the following codes:

- SAW salary and wages

- CHP Closely Held Payee

- LAB Labour Hire

- SWP Seasonal Worker Programme

- WHM Working Holiday Maker

- VOL Voluntary Agreement

- TFN/ABN: for VOL, add the ABN, add TFN for all other employment types

- Payroll Number: enter the employee's payroll number

- First Name: enter the employee's first name

- Given Name(s): enter the employee's given name(s) - optional

- Last Name: enter the employee's last name

- Date of Birth: enter the employee's date of birth - date format (DD/MM/YYYY)

- Address Line 1: enter the employee's address line 1

- Address Line 2: enter the employee's address line 2 - optional

- Suburb: enter the employee's suburb

- State: enter the employee's state

- Postcode: enter the employee's postcode

- Employment Date: enter the employee's employment start date - date format (DD/MM/YYYY)

- Employment Type: it must be one of the following codes:

- F Full Time

- P Part Time

- C Casual

- D Casual(on-call)

- L Labour Hire

- S Senior or Pension

- V Voluntary Agreement

- Tax Treatment: enter the 6-character tax code, check the Tax Treatment Code guide

- Terminated: enter N for active employees, Y for employees with terminated employment

- Termination Date: enter the termination date for employees with terminated employment - date format (DD/MM/YYYY)

- Termination Reason: must be one of the following:

- C Contract Cessation

- D Deceased

- F Dismissal

- I Ill Health

- R Redundancy

- T Transfer

- V Voluntary Cessation

- Tax Offset Amount: enter the amount of any tax offset

- Payment Date From: payment cycle start date

- Payment Date To: payment cycle end date

- Final Pay: enter Y if this is the final pay for this financial year

- Gross: enter the Year to Date Gross

- Tax: enter the Year to Date Tax withheld

- Super: enter the Year to Date Super amount

- Salary Sacrifice Super: enter the employee's salary sacrifice amount (Voluntary or Mandated)

- Salary Sacrifice Others: enter the employee's other salary sacrifice

- Super RESC: enter the employee's Reportable Employer Super Contribution

- Directors' Fees: enter the directors' fees payment

- Bonus & Commissions: enter the employee's bonus or commissions payment

- Overtime: enter the employee's overtime payment

- CDEP: enter the employee's Community Development Employment Project

- Cents per Kilometre

- Award Transport Payments

- Laundry

- Overtime Meal Allowances

- Domestic or Overseas Travel Allowances

- Tool Allowances

- Tasks

- Qualifications/Certificates

- General

- Home Office

- NON-DEDUCTIBLE

- PRIVATE VEHICLE

- TRANSPORT/FARES

- UNIFORM

- Child Support Deduction

- Child Support Garnishee

- Union Fees

- Workplace Giving

- Lump Sum A (R.): unused leave type R

- Lump Sum A (T.): unused leave type T

- Lump Sum B: for unused long service leave

- Lump Sum D: tax free amounts

- Lump Sum E: back payment

- Lump Sum E Financial Year: for lump sum E, you must enter the relevant financial year

- Lump Sum W: back to work payment

- Ancillary and defence leave: for special type of leave such as jury duty or defence purpose

- Cash out of leave in service: any cahsed out leave payment

- Other paid leave: any other leave payment that is not listed

- Paid parental leave: parental payment that was paid by the employer

- Unused leave on termination: paid unused leave on termination

- Workers compensation: any paid worker compensation amount

- Code: enter the relevant ETP code

- Date: enter the ETP payment date

- Taxable Amount: enter the ETP taxable gross amount

- Tax Free Amount: enter the ETP tax free amount

- Tax Withheld: enter the ETP tax withheld amount

Report RESC amount only if the employee has the capacity to influence the amount or way it is contributed for salary sacrifice or excess super. RESC amounts should also be reported under the Salary Sacrifice Super field

The next fields are related to employee's allowances

The next fields are related to employee's deductions

The next fields are related to employee's lump sum payments

The next fields are related to employee's leave payment

The next fields are related to employee's employment termination payment (ETP)

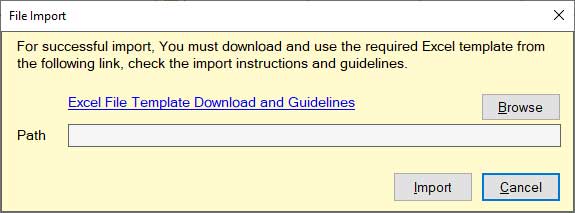

Importing Single Touch Payroll

Follow the next steps:

- Click on S.T.P. from the application toolbar

- Click New

- The Single Touch Payroll window appears, click the Excel icon

- The File Import window appears, click Browse

- Click Browse

- Select the excel file which contains all the information that you would like to import

- Click Import

- You should see a list of all employees found in the excel file

Make sure to download the excel template and read the import guidline on top of the page.

Make sure to check the imported data to ensure that the correct information was imported.